We make shadow payroll simple for your business

We enhance your existing payroll operations to simplify shadow payroll processes

No more estimates! Get real-time, accurate shadow payroll calculations in seconds.

Watch Video

We understand that shadow payroll can be challenging

Certino is here to help. We provide solutions for...

- Disparate data collection

- Excessive admin time

- Process inefficiencies

- Unnecessary costs and fees

- Complicated local payroll calculations

- Inaccurate estimates

- Compliance risks

- Employee dissatisfaction

Certino helps you save time, reduce costs and stay compliant

If you have employees working overseas, they may have a tax obligation in the host country that cannot be calculated within your normal payroll process.

How we solve your shadow payroll challenges

We combine experienced tax specialists with innovative technology to solve and simplify shadow payroll

Centralised Data

No more manual data crunching. Process data centrally in a single format, with APIs for ease of integration with tools like HRIS and payroll platforms.

Confident Calculations

Fast, verified tax calculations are returned in seconds. Our specialist in-house tax team ensures our calculations are in compliance with all legislative rules and regularly update the payroll tax engines.

Streamlined Processes

Automate upstream and downstream processes with payroll consultancy and rapid calculations returned within seconds, not days.

Robust Compliance

Mitigate the reputational risk and financial costs of penalties from non-compliance.

One Point Of Contact For All Countries

We talk to the local payrolls during set-up to discover exactly what they need for compliant shadow payroll calculations.

Fast Payroll Turnarounds

Turn manual payroll tasks into automated workflows and eliminate human error.

Minimise Administration

Remove the administration time that impacts your productivity by streamlining your data flow.

Reduce Costs

Save money by reducing additional third-party fees and avoid potential penalties, interest, and audits due to inefficient compliance.

Increase Employee Satisfaction

Minimise disruption to employees with accurate monthly payments and no year-end revisions, supporting flexible working demands.

Seamless integration with tax and mobility programs

Simplify complex tax calculations, remain compliant with international tax laws and maximise cost savings.

Our Technology

- The world’s first SPaaS (Shadow Payroll as a Service), designed and maintained by experienced tax experts.

- Access our cloud based platform through our intuitive web application or API integration.

- Calculate shadow payroll accurately with near global coverage.

- Calculations returned in seconds not days.

- Standardised format for data submission.

Our Services

- Fast-track your new shadow payroll processes with Certino support services and training.

- Dedicated Certino consultancy from experienced tax experts to accompany the use of our tools.

- Optional additional expert consultancy services to enhance your overall shadow payroll process.

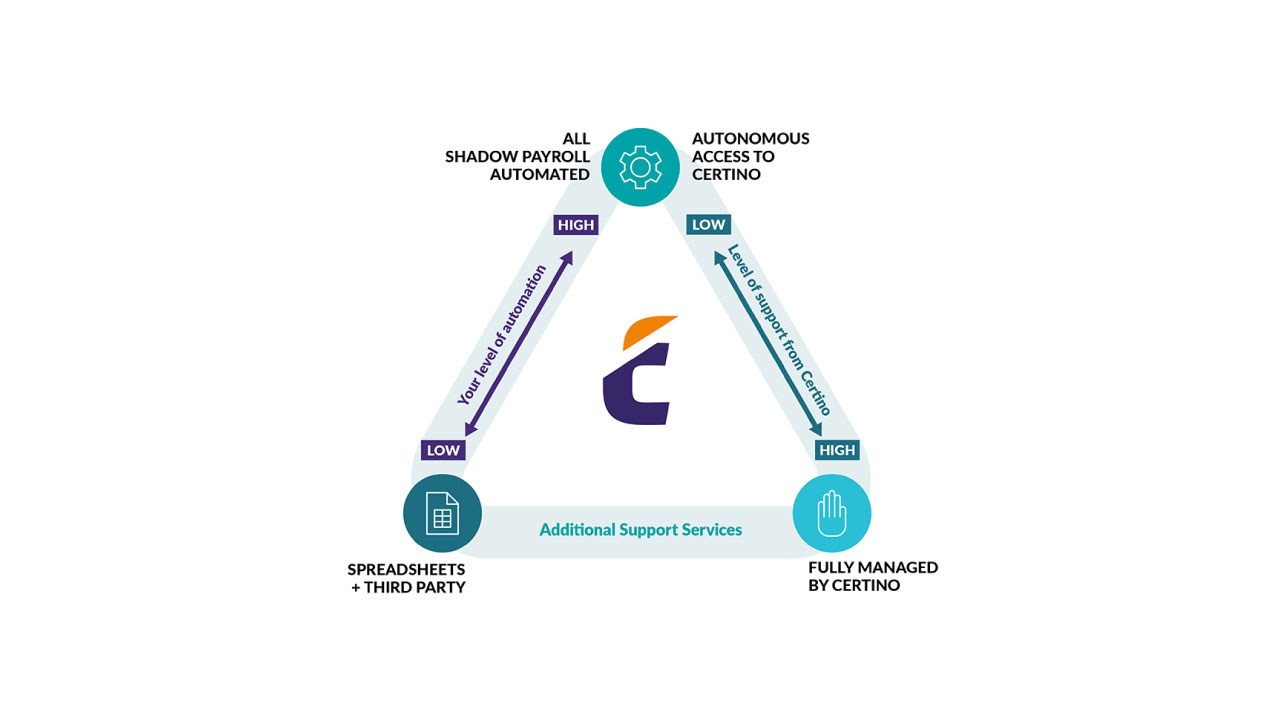

Certino level of support

No matter what your existing shadow payroll process looks like, we’ve got a solution for you.

Take advantage of a fully-managed service, or get started quickly with autonomous access.

Having access to a technology platform like Certino, which fully automates the process and reduces time, resources and costs is something Global Mobility teams and their functional stakeholders will really welcome.

Siobhan Cummins – Global Mobility Leader

Simplify your shadow payroll today

Insights from our blog

.png)

.png)

24 January 2023 | Shadow Payroll, Technology,

The 5 Principles of successful technology adoption

-1.png)

.png)